Riding the Wave: An In-Depth Look at Mukka Proteins IPO GMP

Mukka Proteins IPO GMP

In the bustling world of initial public offerings (IPOs), few tales capture the imagination quite like that of Mukka Proteins. Amid fluctuating market trends and investor anticipation, the Mukka Proteins IPO Grey Market Premium (GMP) emerges as a beacon for those aiming to gauge the market sentiment before the actual listing. This article invites you on a journey through the intricacies of this IPO, unraveling why it stands as a pivotal moment for both the industry and potential investors.

Introduction

Have you ever considered investing in an IPO, only to find yourself lost in a sea of market jargon and speculative forecasts? You’re not alone. Enter Mukka Proteins, a company set to redefine the landscape with its forthcoming IPO. In this article, we will decode the buzz around Mukka Proteins’ IPO GMP, providing you with a comprehensive understanding that demystifies the process and illuminates the investment path ahead.

Gearing Up for the IPO

What is an IPO?

- IPO stands for Initial Public Offering, a crucial phase where a private company offers shares to the public for the first time.

- This transition to a public entity can be a goldmine for early investors, provided they navigate the waters wisely.

The Significance of GMP

- GMP, or Grey Market Premium, is an unofficial indicator of how the market perceives the IPO.

- It refers to the premium at which IPO shares are traded in the grey market before they are officially listed on stock exchanges.

Understanding the dynamics of GMP can offer invaluable insights into the initial performance of Mukka Proteins’ stock, serving as a weather vane for investor interest and market sentiment.

Mukka Proteins IPO: A Closer Look

Mukka Proteins is not just another startup making bold promises. With a robust market presence and an eye for innovation, the company has charted a path of strategic growth that merits investor attention.

The Journey So Far

Mukka Proteins has carved a niche for itself in the protein supply industry, an achievement that speaks volumes about its market acumen and future potential.

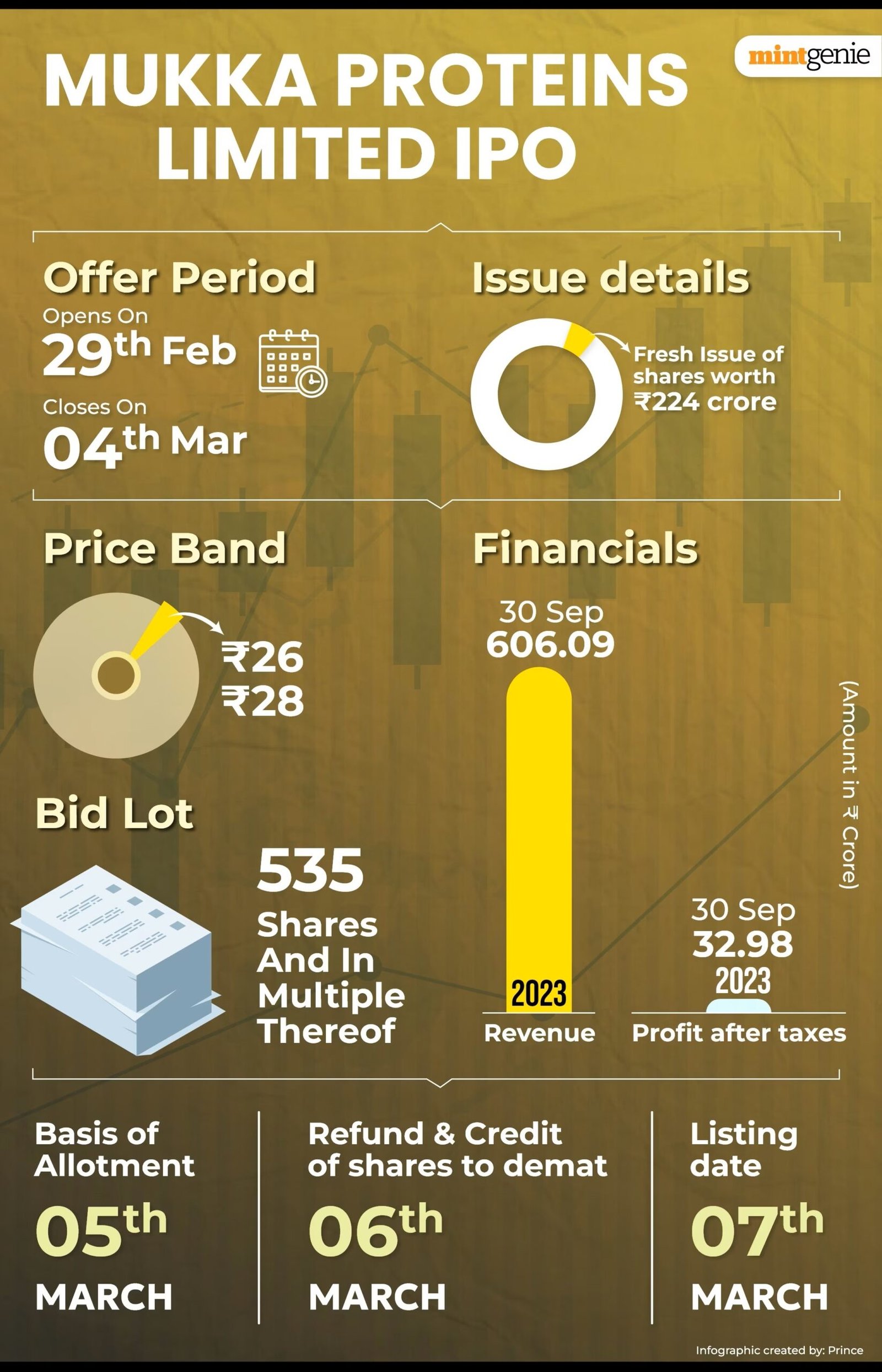

The IPO Details

- Offering Size: Details about the number of shares and the price range.

- Objective: Expansion? Debt repayment? We delve into what the company aims to achieve with the funds.

Understanding these facets provides a groundwork for evaluating the IPO’s attractiveness and aligning it with your investment goals.

Decoding the GMP

The Grey Market Premium (GMP) is a litmus test for the IPO’s anticipated performance.

Why GMP Matters

- A robust GMP suggests high investor confidence, whereas a low or negative GMP can signal caution.

- GMP fluctuates based on a myriad of factors including market conditions, investor sentiment, and the company’s pre-IPO performance.

By examining the GMP closely, investors can tailor their strategies to match their risk appetite and investment philosophy.

Risks and Rewards

The Investment Periphery

- Risks: From market volatility to the company’s growth trajectory post-IPO.

- Rewards: Potential early gains, portfolio diversification, and being part of Mukka Proteins’ growth story.

An informed decision is the bedrock of successful investing, and weighing these aspects is paramount.

Conclusion

The Mukka Proteins IPO and its Grey Market Premium offer a fascinating glimpse into the mechanisms of public offerings and market dynamics. Whether you’re an experienced investor or a curious novice, understanding the nuances of this IPO can significantly impact your investment journey.

“An informed investor is an empowered investor.”

As we watch Mukka Proteins stride towards its public offering, the GMP serves as both a guide and a gauge for market expectations. By embracing a vigilant and informed approach, one can navigate the IPO waters, aiming not just for opportunistic gains but for strategic growth. Let the Mukka Proteins IPO be your gateway to mastering the art of investment in the IPO ecosystem.

Learn More- The Rameshwaram Cafe Explosion in Bangalore